the sense and purpose of life insurance

Life insurance, health insurance, best insurance

insurance is important - habibieDalam insured life

insurance is caused by the death (death). The deaths resulted in loss of income

of a person or a particular family. Risks which may arise in the life insurance

mainly lies in the timing (time), therefore it is difficult to know when

someone dies. To minimize these risks should be insured life insurance

customers.

What is a life insurance?

Understanding life insurance is the insurance that

aims to bear against unexpected financial losses caused by the death of his

life too fast or too long. Here illustrated that in life insurance, the risks

faced are:

1. The risk of death.

2. Life someone too long.

It is, of course, will bring a lot of aspects, if

the risks inherent in a person is not insured with a life insurance company.

For example guarantees for descent (dependents), a

father that died prematurely or with a sudden, the child will not be neglected

in her life.

It could also happen to a person who has reached the

age ketuaannya (old age) and not being able to earn a living so it is not able

to pay for her children, then by a customer at Allianz life insurance risks

that may be suffered in terms of lost opportunities to earn a living will be

borne by insurance company.

Life insurance institutions have boondoggle with the

main goal is to assume or guarantee person against financial losses. Below we

can see how important the role and purpose of life insurance.

1. In terms of the general public (social)

Life insurance can provide certain benefits to the

individual or society, is as follows.

- Reassuring head of the family (husband / father), in the sense of giving income security, education, if the head of the affected families which caused death.

- By purchasing a life insurance policy can be used as a tool for saving (saving). In general, the per capita income of the people is still very low, therefore, in practice it appears that people's desire to buy a little life insurance.

- As a source of income (earning power).

This can be seen in countries that have been

developed, one which is "key" in the company will be insured by the

company where he worked. This needs to be done given the importance of the

position he held. Many would least affect on the lives of the company's going

concern (ongoing). For example an atomic / nuclear will be insured his soul

when he dies or illness, the company is obliged to pay compensation. These

examples do not we meet in Indonesia, because our country is not yet so

advanced in the industry when compared to western countries.

- Another purpose of life insurance is to ensure the treatment and warrants to suppose that insure offspring can not afford to educate their children (scholarship / education). That many of us encounter in practice is, insurance coverage for the risk of death, while the rest of coverage yet so advanced rapidly.

2. In terms of the government / public.

Life insurance companies in our country are large

operations, generally belongs to the government. Here we connect with

government regulations, namely Law No. 19/1960 on the division between state

enterprises. The division of activities as listed in the following sectors.

- Production sector (state industrial enterprises, state-owned plantation company, and the state mining company).

- Marketing sector (commercial company).

- Sector provision of facilities (state insurance companies, government banks and other state-owned service companies).

It can be concluded here that the insurance company

is a financial institution that provides financing facilities to be used in the

stage of economic development of Indonesia. Based on Law No. 19/1960, turns

contribution to the economic development of insurance institutions are:

- As a means of capital formation (capital formation).

- Savings institutions (saving).

So it can be said that the purpose of the insurance

company is to help build a national economy in the field of life insurance per

accordance with Repelita, by prioritizing the needs of the people and the peace

and pleasure of working within the company towards a just and prosperous

society materially and spiritually.

Glance E-Insurance

Glance E-Insurance

Demand

transparency in the financial services sector, including insurance companies

are affected by the growth of the information society in Indonesia are getting

used to finding information on the Internet. According to Khan and Ismail

(2012), the Internet became one of the resources most frequently used by the

community. Compared with other financial institutions sector, intensive

applying for achieving sustainable competitiveness, the insurance sector is

relatively slower in applying the principles of e-commerce (Grossman et al,

2004).

According

to Ahonen and Windischhofer (2005), the insurance business that has characteristics

of complex products or services face significant challenges in developing

insurance services based electronics. The shift to a form of media or

information systems that can be accessed by the public requires a paradigm

shift in the management of information, both internally and externally.

Posted by Unknown

Insurance contribution against Economy

Insurance contribution against Economy

This

article describes the conditions and contribution glimpse of insurance

companies in the national economy. Changes in the external environment, in

particular economic variables will have an impact on insurance companies.

Economic growth as well as growth in people's income is a factor that can

influence the potential and prospects of the insurance industry. At the macro

level, the insurance company's performance will be affected from the decline in

activity or the economic development of a country. Some studies show the

relationship between the insurance industry and economic growth in one or

several countries.

Theoretically

the relationship between insurance development and economic growth are causal

relationship, but the critical question is which one is more powerful as a

major contributor? Or in other words, which are at the cause and effect.

Economic growth supports the growth of the insurance or insurance growth to

support economic growth? The answer requires in-depth analysis, which combines

theoretical and empirical perspectives. Theoretical standpoint means discusses

general insurance principles associated with the source and use of dana-

related to the mobilization of public funds in the form of premiums and the

management of these funds for investment purposes. The principle was

subsequently linked with the insurance position as a financial institution in

the mechanism of circular flow of income- a simple economic model that

describes the interconnectedness between economic operators.

In

2013 the total value of world premium in the amount of USD 4,640,941 million

consisting of life insurance premiums of USD 2,608,091 million and general

insurance premiums amounted to US $ 2,032,850 million. By using nominal values,

premiums decreased in 2013, but when adjusted for inflation, total premium

world showed growth of 1.4% for total, 0.7% for life insurance premiums and

2.3% for general insurance. ASEAN region experienced relatively higher growth

than the world average is 9.5% for total premiums, 10.1% for life insurance

premiums, and 8.1% for general insurance.

Indonesian

insurance penetration is still below the world average, Asia, and ASEAN.

Insurance penetration in Indonesia by 2.1 percent to total premium, while the

world average, Asia, and the third consecutive ASEAN amounted to 6.28%, 5.37%

and 3.35%. The position of the insurance density is also relatively the same

which is still below the world average. Premiums per capita Indonesia row of

USD 77 for a total premium, USD 59 for life insurance, and $ 18 for general

insurance. This value is still below Singapore, Malaysia, and

Thailand-spoken-also has reached USD 2388, USD 341 and USD 214 for the total

premium, but still above the Philippines and Vietnam amounted to USD 54 and USD

23. The low insurance density can be understood as the Indonesian population

greater. Indonesia still has a huge potential if relying on the potential of

the population, especially if supported by revenue growth.

Posted by Unknown

Understanding Health Insurance

Health

insurance is one of the types of insurance products that specifically

guarantees the maintenance cost of health care or insurance clients is if they

have health problems or accidents. Broadly speaking there are two types of

treatments are offered by insurance companies, namely outpatient and inpatient.

Outpatient

Outpatient

insurance covers the cost of a doctor, diagnosis / lab, and medicine. The costs

incurred are usually determined by the maximum limit for each component per

visit / per year and a maximum frequency of visits in one year. Restrictions

can also be enforced by requiring GP referral before a visit to a specialist,

or coverage only given when health services performed by the service providers

listed. Outpatient insurance is usually only an additional benefit of

hospitalization insurance. In other words, should be the one with the

hospitalization insurance.

Inpatient

Hospitalization

insurance covers the cost of inpatient care in hospitals, which includes the

cost of the room, physician services, drugs, laboratory / diagnostic support,

surgery, etc. Hospitalization insurance classification is usually done by the

class room.

Insurance history

History beginning Insurance

Insurance

originated from the people of Babylon 4000-3000 BC known as Hammurabi

agreement. Then in 1668 AD at the Coffee House Lloyd's of London London stands

as the forerunner of conventional insurance. Sources of insurance law is a

positive law, natural law and existing examples as culture.

Insurance

brings economic as well as social mission with the premiums paid to the

insurance company to guarantee adanyatransfer of risk, namely the transfer

(transfer) the risk from the insured to the insurer. Insurance as a risk

transfer mechanism where the individual or business move some uncertainty in

exchange for premium payments. The definition of risk here is that uncertainty

occurs whether or not a loss (the uncertainty of loss).

Insurance in Indonesia started in the Dutch

colonial period, associated with the success of the country's companies in the

plantation sector and trade in Indonesia. To meet the needs of assurance of

continuity of business, certainly required of insurance. The development of the

insurance industry in Indonesia had a vacuum during the Japanese colonial

period.

Insurance history in Indonesia

Insurance

business into Indonesia during Dutch colonial rule and our country at that time

was called Nederlands Indie. The existence of insurance in our country as a

result of the success of the Dutch in the plantation sector and trade in the

colonies.

To ensure

continuity of business, then the insurance is absolutely necessary. Thus the

insurance business in Indonesia can be divided into two periods, namely the

colonial period until 1942 and the period after World War II or the time of

independence. At the time of the Japanese occupation army for approximately

three and a half years, almost did not record the history of the development.

Insurance

companies in the Dutch East Indies during the colonial period were:

The companies founded by the Dutch.

Companies that are branch offices of insurance companies

headquartered in the Netherlands, the UK and in other countries.

With the

monopoly systems that run in the Indies, the development of insurance in the

Dutch East Indies restricted to commercial activity and the interests of the

Dutch, British, and other European nations. The benefits and the role of

insurance is not known by the public, especially by indigenous communities.

This type

of insurance has been introduced in the Indies at that time was still very

limited and mostly consists of fire insurance and transport.

Motor

insurance still play a role, because the number of vehicles is still very

little and only owned by the Dutch and other foreign nation. In the colonial

era not recorded a single insurance company. During the World War II activities

of insurance business in Indonesia practically stalled, mainly due to the

closure pemsahaan- insurance company owned Dutch and English.

Insurance era of independence

After the

war ended, the company and the British-Dutch company resumed operations in this

country already independent. Until 1964 the insurance industry market in

Indonesia is still dominated by a foreign company, especially the Netherlands

and the United Kingdom.

In the beginning operate in Indonesia they established a body

called "Bataviasche Verzekerings Unie" (BVU) in 1946, which conducts

collective insurance. Thus from each closing, each member BVU obtain a certain

share. How this is done in view of the circumstances at the time the power has

not been regular and insurance are lacking at all.

In 1950 the company established a first loss insurance,

namely NV. These Insurance Indonesia which then in early 2004 has become PT MAI

PARK. At that time, as a pioneer of national insurance companies first, then

the company must compete with foreign insurance companies that excel both in

the capital factor nor the technical knowledge.

With the

establishment of the national insurance company, courage national entrepreneurs

are encouraged to set up insurance companies. Courage is also supported by

government regulation that all imported goods must be insured in Indonesia.

This arrangement is intended to combat the use of foreign exchange to pay

insurance premiums abroad.

In 1953

also stood a national private company engaged in reinsurance Dutch and British

in Indonesia, the use of foreign exchange to pay reinsurance premiums abroad

also remains large. To cope with this, founded in 1954 a professional

reinsurance company, namely "PT. REINSURANCE .UMUM INDONESIA "which received

support from state banks.

The latter

institution issuing binding regulations for foreign insurance companies to

menggunakanjasa national reinsurance company. The steps taken by the government

in this case provide the expected results. Activity PT. General Reinsurance

Indonesia in 1963 extended the life reinsurance activities.

At the time

PT. General Reinsurance Indonesia was established, many insurance companies

have sprung up nationwide, but its development is still hampered by heavy

competition from private insurance companies are foreign. At the time of the

struggle mengembaiikan West Irian to the Republic of Indonesia, the government

nationalized the Dutch-owned company. British companies were nationalized in

the confrontation.

Posted by Unknown

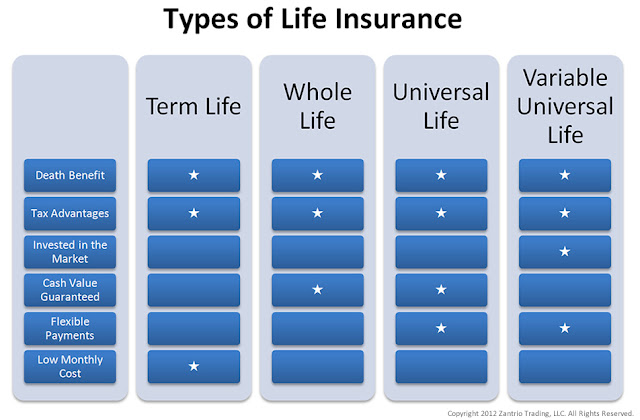

Types of Life Insurance in Indonesia

Term Life Insurance

insuranceAsuransi term life term life (futures)

serves to provide protection to the insured within a certain period only. The

advantages of this product is the customers get the freedom to determine

premiums according to their abilities. Ideally, insurance premiums starting

from Rp. 250,000 per month.

Another plus is the sum that can be obtained by the

policyholder could reach billions of dollars. This means that when the insured

dies while the contract period is still active, then the family of the insured

will get the insurance money very much.

Meanwhile, the lack of term life insurance is the

insured may lose policyholders and their insurance money if he did not have

health problems and died until the contract expires. This makes a lot of

insurers began to abandon this insurance product.

Whole Life Insurance

whole life insuranceAsuransi whole life (lifetime)

is an insurance product that provides the benefits of protection up to 99

years. The best part is this insurance allows policyholders to obtain cash

value and the policy that has been paid. Another added value is if the insured

can not pay the premium installments regularly, they can use the cash value of

premiums already paid to pay further premiums.

Kekuranganya is the insurance premium is more

expensive than term life insurance premiums (can be 2-fold or even more). This

is caused because the life expectancy of the people of Indonesia for men is 65

years, while a woman is 70 years old so that insurance claims before the end of

protection there must be.

In addition, the cash value and the total premium

that is given is not too much because the insurance rate is only 4% of it per

year. The worst part, the interest will be taxed so that customers can only

receive the cash value is low or even none at all.

Endowment insurance

endowmentJenis insurance latter are endowment

insurance (endowment) which is a term life insurance as well as savings. This

means that the policyholder can get the cash value of the insurance premium

already paid and could draw the insurance policy within a certain time before

the contract expires. For example, the insured needs education funds to send

their children, then he can claim his life insurance policy with an insurance

record is only given in a few years according to the agreement.

Disadvantages of this insurance product is fairly

expensive premiums because this product has two functions. This makes this type

of insurance is only interested by the upper middle class who can afford to

spend millions of dollars to pay a premium per month.

For additional information, there are now manifold

Unitlink life insurance is increasingly popular because of the type of life

insurance has value and investment protection promise. This means that

customers who buy insurance unitlink not only get a guarantee of protection,

but also the value of investments with high interest annually as well as

additional benefits.

These investments are managed entirely by the

insurance, the policyholder just waiting for the distribution of profits alone.

However, unit-linked insurance also has shortcomings where the policyholder

will only get lower insurance policy if their investment fails or produces only

slight gains.

Life Insurance

Types of Life Insurance

life insurance cSebelum discusses the types of life

insurance, if any of you who still think that buying life insurance is not

important? If there is, it's good to listen to some facts below that make life

insurance is so important for the entire community:

- Every 7 people who died in Indonesia, one of them because stroke.-Ministry of Health of Indonesia, 2011.

- Deaths from non-communicable diseases increased to 59.5% in 2007.-Minister of Health Endang Rahayu Sedyaningsih 2011.

- Based on the survey of World Health Organization (WHO) in 2002, 10 causes of death in Indonesia is coronary heart disease, tuberculosis, blood vessel disorders, respiratory diseases, diseases of the newborn, lung disease, traffic accidents, diabetes mellitus, high blood pressure, and diarrhea ,

- Tower Watson's 2011 Global Trends Medial mention health care costs in Indonesia meninggkat 10 to 14% in the last three years.

These facts are enough logical reason to buy life

insurance. You certainly do not want it when you died or suffered permanent

disability troubling your family?

Well, if you're interested in buying life

insurance, you must know in advance the types of life insurance in order to buy

the right insurance products. Currently there are three types of life insurance

products used by life insurance companies in Indonesia.

Posted by Unknown