Archive for July 2015

Types of Life Insurance in Indonesia

Term Life Insurance

insuranceAsuransi term life term life (futures)

serves to provide protection to the insured within a certain period only. The

advantages of this product is the customers get the freedom to determine

premiums according to their abilities. Ideally, insurance premiums starting

from Rp. 250,000 per month.

Another plus is the sum that can be obtained by the

policyholder could reach billions of dollars. This means that when the insured

dies while the contract period is still active, then the family of the insured

will get the insurance money very much.

Meanwhile, the lack of term life insurance is the

insured may lose policyholders and their insurance money if he did not have

health problems and died until the contract expires. This makes a lot of

insurers began to abandon this insurance product.

Whole Life Insurance

whole life insuranceAsuransi whole life (lifetime)

is an insurance product that provides the benefits of protection up to 99

years. The best part is this insurance allows policyholders to obtain cash

value and the policy that has been paid. Another added value is if the insured

can not pay the premium installments regularly, they can use the cash value of

premiums already paid to pay further premiums.

Kekuranganya is the insurance premium is more

expensive than term life insurance premiums (can be 2-fold or even more). This

is caused because the life expectancy of the people of Indonesia for men is 65

years, while a woman is 70 years old so that insurance claims before the end of

protection there must be.

In addition, the cash value and the total premium

that is given is not too much because the insurance rate is only 4% of it per

year. The worst part, the interest will be taxed so that customers can only

receive the cash value is low or even none at all.

Endowment insurance

endowmentJenis insurance latter are endowment

insurance (endowment) which is a term life insurance as well as savings. This

means that the policyholder can get the cash value of the insurance premium

already paid and could draw the insurance policy within a certain time before

the contract expires. For example, the insured needs education funds to send

their children, then he can claim his life insurance policy with an insurance

record is only given in a few years according to the agreement.

Disadvantages of this insurance product is fairly

expensive premiums because this product has two functions. This makes this type

of insurance is only interested by the upper middle class who can afford to

spend millions of dollars to pay a premium per month.

For additional information, there are now manifold

Unitlink life insurance is increasingly popular because of the type of life

insurance has value and investment protection promise. This means that

customers who buy insurance unitlink not only get a guarantee of protection,

but also the value of investments with high interest annually as well as

additional benefits.

These investments are managed entirely by the

insurance, the policyholder just waiting for the distribution of profits alone.

However, unit-linked insurance also has shortcomings where the policyholder

will only get lower insurance policy if their investment fails or produces only

slight gains.

Life Insurance

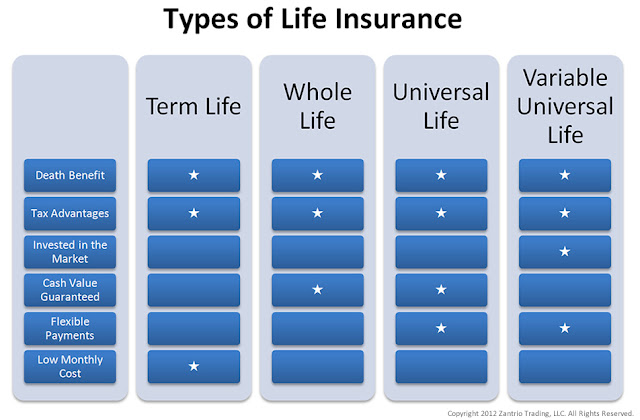

Types of Life Insurance

life insurance cSebelum discusses the types of life

insurance, if any of you who still think that buying life insurance is not

important? If there is, it's good to listen to some facts below that make life

insurance is so important for the entire community:

- Every 7 people who died in Indonesia, one of them because stroke.-Ministry of Health of Indonesia, 2011.

- Deaths from non-communicable diseases increased to 59.5% in 2007.-Minister of Health Endang Rahayu Sedyaningsih 2011.

- Based on the survey of World Health Organization (WHO) in 2002, 10 causes of death in Indonesia is coronary heart disease, tuberculosis, blood vessel disorders, respiratory diseases, diseases of the newborn, lung disease, traffic accidents, diabetes mellitus, high blood pressure, and diarrhea ,

- Tower Watson's 2011 Global Trends Medial mention health care costs in Indonesia meninggkat 10 to 14% in the last three years.

These facts are enough logical reason to buy life

insurance. You certainly do not want it when you died or suffered permanent

disability troubling your family?

Well, if you're interested in buying life

insurance, you must know in advance the types of life insurance in order to buy

the right insurance products. Currently there are three types of life insurance

products used by life insurance companies in Indonesia.

Posted by Unknown

advantage car insurance

5 Main Advantages Of Insuring Your Car in Indonesia

There are many advantages that you can get to have

insurance, whether it be life, health, car, home, or any other type.

Unfortunately, despite many people realize the importance of having insurance,

many are still not aware of how important it is protected by insurance. Many

people are still ignoring the usefulness of insurance and the fact that they

will be spared from the worst possible, by having this type of investment.

One of the most important insurance to have is car

insurance. Given that mobility is one of the most important things in everyday

life, is quite reasonable if you begin to prepare for and protect one of your

assets with insurance. Let's look at the statistics the number of accidents

involving vehicles and died of injuries - including material loss - from 1992

to 2011.

We can see from these statistics that the number of

accidents is increasing from year to year. Maybe this time you are thankful

that you are not involved in the incidents of vehicles on the road, but could

you estimate the same thing in the future? What if you are involved in an

accident in which you become a victim? What if one of your family members

involved in the accident - either as victims or perpetrators? Insurance does

not guarantee that you will be separated from these problems, but at least you

do not have to constantly feel worried or afraid, lest you be involved in

incidents like those mentioned above.

After all, you can actually enjoy the benefits of

their car insurance. Here are the advantages of having such insurance:

- you can be free from the burden of thinking and fear that constantly. Haunted by anxiety that is not fun, is not it? Not only will it make your life is not quiet, you may develop the disease due to the stress of whack. With the insurance, at least you can feel at ease in performing daily life; not constantly feel worried or even become paranoid - the term now is paranoid. When you leave the house, there is no fear involved in an accident so your work productivity and comfort in driving will not be affected at all.

- you will be free from economic burden if something bad happens. Having a car does not mean you live in abundance. Many people who have limited income are forced to have a car because of the demands of work and high mobility. Imagine if in the midst of limited income that you are involved in a car accident, which led to you not only have to pay extra for repairs and also for medical expenses. Your expenses will automatically be doubled if you are the guilty party, so you have to bear the costs of the other party involved. You could have involved a huge debt, which of course would be an extra burden on you financially.

- have insurance frees you from the responsibility of a third party. Driving accidents can occur due to a single cause or involve other parties. If you are involved in a single accident, you do not need to worry about having to bear the burden of the cost of the other party. After all, you only think about yourself. Another case if there are others involved. With the insurance, not only you will be relieved of the costs of your own, you do not have to pay for a third party involved in the accident; let care insurance. Whether it's the cost of repairs and medical care, all of them can be excluded by insurance.

- insurance frees you from the extra costs in case of natural disasters or other incidents. We know that natural disasters are unpredictable or predictable. In the event of landslides, floods, earthquakes, or other things - that cause damage to your car - insurance will be ready to protect you. Including if you have follow-destruction (vandalism) or car theft.

- the insurance could be a good investment vehicle. If you think to save money while protecting your assets, insurance can be a very appropriate choice. Is not it nice to have all the means that can include multiple destinations at once?

Definition, Function, Purpose, Insurance.

Definition Definition.

Insurance is derived from the word that means the

insurance coverage. Insurance is an agreement between the insured or the

customer with the insurer or insurers. The insurer is willing to bear some

losses that may arise in the future after the insured agreed on the payment of

money called a premium. The premium is the money spent by the insured as

compensation to the insurer.

Under the Code of Commercial Law (Commercial code),

Insurance or Assured is defined as an agreement by which a binding to an

insured, to receive a premium, to provide reimbursement to him for the loss,

damage or loss of expected profit, which may be experienced as an event that is

not certain.

Formally, in the legislation, insurance is defined

as an agreement between two or more parties, which the parties committed

themselves to the insured person, by accepting insurance premiums, to provide

reimbursement to the insured for the loss, damage or loss of expected profit or

responsibility law third parties that may be suffered by the insured, arising

from an uncertain events, or giving a payment based on death or life of an

insured person.

The terms of the insurance agreement and the rights

and obligations of the parties contained in an insurance policy. Examples of

these are insurance life insurance, accident, loss, health and fire insurance.

Party risk that channel referred to as the

"insured", it is customers or people who delegate or transfer the

risk to be received, while the party receiving the risks referred to as the

"insurer" is the insurance companies that underwrite or replace the

loss of the customer.

Agreement between the two sides is called a policy.

This policy is a legal contract that explains all terms and conditions are

protected. fees paid by the "insured" to the "guarantor"

for the risk borne referred to as "premium". It's great value premium

is generally determined by the "insurer" which consists of funds that

can be claimed in the future, administrative costs, and profits.

Function Purpose Insurance

The main function of insurance is a mechanism of

transfer / transfer of risk or a risk transfer mechanism, which transfer risk

from one party to the other party, namely the insured that the insurer. The

transfer of risk is by no means eliminates the possibility of misfortune, but

the insurer to provide financial security facilities or financial security and

tranquility or peace of mind for the insured. In return, the insured is obliged

to pay premiums in a relatively small amount when compared with the potential

losses that might be natural.

Basic Principles of Insurance:

The basic principles that must be met by

institutions or companies engaged in the insurance business are:

- Insurable interest is the right to insure arising from a financial relationship between the insured and the insured with a legally recognized.

- Utmost good faith is An action to disclose accurately and completely, all the material facts or material fact about something to be insured whether requested or not. What it means is: the insurer must honestly explain clearly everything about the extent of the terms / conditions of insurance and the insured must also provide a clear and correct for objects or interests of the insured.

- Proximate cause is a cause of an active, efficient cause that chain of events that lead to a result without the intervention of the start and actively from new and independent source.

- Indemnity is a mechanism by which the insurer providing financial compensation to put the insured in a financial position that he had prior to the loss.

- Subrogation is the transfer of rights to demand from the insured to the insurer after a claim has been paid.

- Contribution is the Right of the insurer to invite other equally bear, but not necessarily the same obligations to the insured to help provide indemnity.

Posted by Unknown

insurance for a child's future

Insurance Solutions

Education is the Future of Children

Insurance Solutions Education is the Future of Children - Immediately prepare for your child's education savings early, but many of the parents save their money in the savings bank with a perfunctory, without regard to the purpose or the costs to be incurred in the future. But what if there is a risk in saving money, you or your child are less fortunate, Suppose Hospital and had to be hospitalized, at least, the savings fund will be taken not for the cost of hospital treatment, your savings would not be reduced? Have you also think that?

One example of educational insurance products we are trying to take away from Commonwealth Life insurance company, and brought the product name Danatra Scholar certainty they prioritize the availability of funds for the education of children in the future.

While having a sense of purpose and the same insurance, education insurance and education savings have different characteristics. According to financial planners Yosi Yunasa, education insurance is insurance plus investment in education, whereas education is an investment savings for education covered by insurance.

Insurance Education is the solution for you who want to guarantee the availability of funds for the education of their children tercinta.Sebenarnya much more sense that your insurance education can help you in choosing the best insurance.

Function Insurance Education

Education Insurance Function - The main purpose of insurance is to shift risk education of our children can not continue their education if there are bad things happen in our lives so that we can no longer make money. To transfer this risk, we have to pay a premium. Thus, the purpose of this insurance is not to make our money grow rapidly, but as a precaution. This insurance can be likened to an umbrella that serves as protector. If it does not happen in our lives, the money we paid for this insurance will be lost. Once again I would like to tap-out that insurance is only for protective and not to make our money doubled.

Insurance education has the characteristic that the investment decision can be adapted to the schedule of your child's school and providing protection function. This means that the availability of funds the education of children remain guaranteed even though the risk of death happen to you

Education insurance is insurance that offers two uses (dual-purpose), which is a function of protection and investment. Protection function will bear the risk of death over you by promising certain amount of money if you experience unexpected events. The sum insured is given usually have adjusted to the cost of your children's education and have been agreed in the policy.

In terms of insurance, there are many more insurance article that discusses a wide range of insurance products in addition to insurance education.